傑出學人專題講座 “Time Series Momentum and Volatility Scaling”

- Written by Benjamin Yau

- Published in 傑出學人專題講座系列

- Permalink

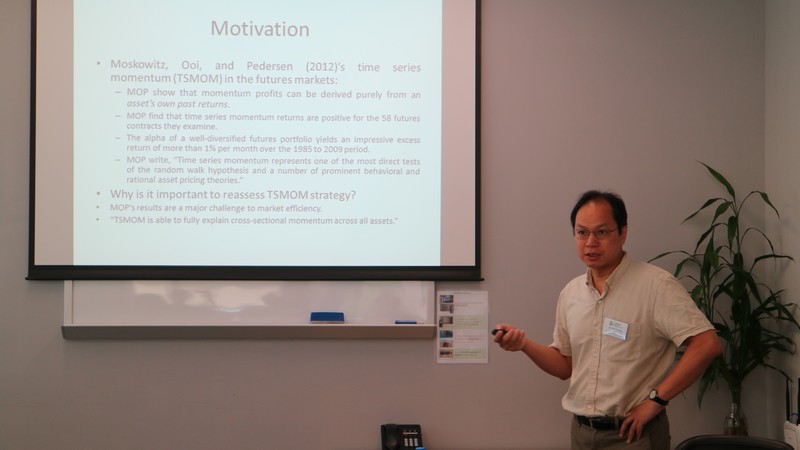

商學院很榮幸邀請到來自密蘇里大學 – 聖路易斯分校 (The University of Missouri – St Louis) 金融學講座教授謝耀文博士,於2016年6月24日到學院主講傑出學人專題講座。謝博士的學術研究資料詳盡和富啓發性,他亦就教職員對有關論題的提問加以深入的闡述,使參加者獲益良多。

是次謝博士以 “Time Series Momentum and Volatility Scaling” 為題發表論文,其概略摘要如下:

“Moskowitz, Ooi, and Pedersen (2012) show that time series momentum delivers a large and significant alpha for a diversified portfolio of international futures contracts. We find that their results are largely driven by volatility-scaling returns (or the so-called risk parity approach to asset allocation) rather than by time series momentum. Without scaling by volatility, time series momentum and a buy-and-hold strategy offer similar cumulative returns, and their alphas are not significantly different. This similarity holds for most sectors and for a combined portfolio of futures contracts. Cross-sectional momentum also offers a higher (similar) alpha than unscaled (scaled) time series momentum.”

欣賞講座影片,可瀏覽以下網址:

第一部分

第二部分

第三部分

第四部分

- motopress-ce-save-in-version:

- 2.0.3